WHAT TO DO FIRST BEFORE GOING TO INDONESIA?

WHAT YOU CAN AND CAN’T PACK?

To have a good trip, the main problem usually comes from the goods you bring along the journey. Thus, you are highly suggested to know the applicable rules that regulating passenger’s belonging from abroad to Bali, Indonesia.

Every passenger from abroad are obligated to declare all the belongings from abroad in Customs Declaration including personal medication, food, beverage, money, etc. Why? It is because the belongings you bring is considered as import goods. Certain goods are not allowed and some needed legal permission. Also, import goods is subjected to tax. However, every passenger is exempted USD 500 per person. If you bring goods with value more than the exemption, the excess will be taxed. Thus, if you are planning to come to Indonesia, you need to check the belongings you can and cannot pack in order to pass the border.

KNOWING WHAT IS PERMITTED AND PROHIBITED!

Permitted goods are still limited and prohibited goods are totally banned. If you are accidentally or not breaking the rules, the fine is applicable. Keep in mind that passenger personal goods are the goods used for personal purposes including the rest supplies.

FYI, used or secondhand goods are prohibitted to enter Indonesia in accordance to Indonesia Trade Ministry Regulation Number 20in 2021. For handphones or other communication device is only allowed 2 pieces/ person, the excess will be detained in accordance to Indonesia Trade Ministry Regulation Number 25 in 2022.

CAN YOU BRING FOOD OR BEVERAGE?

Some food or beverage allowed is still restricted and prohibited to be brought as passenger’s good from abroad to Bali, such as:

- Alcoholic beverage is only allowed 1 litre/ adult passenger (only for 21 years old above) ;

- Cigarettes is only allowed 200 cigarettes, 25 cigars, 100 grams of sliced tobacco or other tobacco products (only for 18 years old above); and

- Raw food (vegetable, fruit, seeds, and meat) is required permission from Quarantine in Country of Origin and Indonesia Quarantine.

Please be aware of Quarantine concern goods such as animal, fish, plant, are obligated to be included with Quarantine permission from abroad and Indonesia.

MEDICINE IS IMPORTANT.

Personal medicine is obligated to be declared in Customs Declaration and highly suggested to present the doctor’s prescription with the same dosage or amount that is prescribed or recommended. Keep in mind, medicine contain with narcotics and marijuana will be executed.

BRING ENOUGH MONEY!

Please be considered in bringing cash money. Every passenger from abroad who bring cash with value more than Rp 100.000.000 or aproximately USD 7000 is OBLIGATED to declare it in Customs Declaration (CD Form). The failure to declare it, administration penalty is applicable (administration penalty is charged 10% from the amount of cash, in accordance to the regulation of Indonesia Ministry of Finance Number 100 in 2018).

UNACCOMPANIED BAGGAGE!

Unaccompanied baggage is passenger’s goods that arrived before and/or after the passenger arrival under these requirements:

-The goods arrive within 30 (thirty) days prior to the arrival of the Passenger or no later than 15 (fifteen) days after the arrival of the Passenger;

-The sender and recipient are under the same name in accordance with the identity in the passport;

-The boarding pass or ticket and passport with immigration stamp are required to be presented to validate the passenger arrival; and

-The new goods found inside the baggage is subjected to tax.

THE LAST BUT NOT LEAST!

Do not forget the important documents that you will need such as passport, boarding ticket, and visa (if required). Make sure that your belonging is safe and will not cause any trouble during your visit or come back to Indonesia. Troubling goods will be processed immediately in order to protect Indonesia and its citizen.

HOW CAN YOUR BELONGING BE KNOWN? CUSTOMS DECLARATION IS THE ANSWER

Before arriving to Indonesia, you will be handed a form to declare all the goods you bring, including food, beverage, money, and other valuable goods, by the airlines crew. The form is a customs declaration. It is a requirement to fill the form since your belongings are considered as import goods. Afterwards, your customs declaration will be synchronized with the luggage you bring.

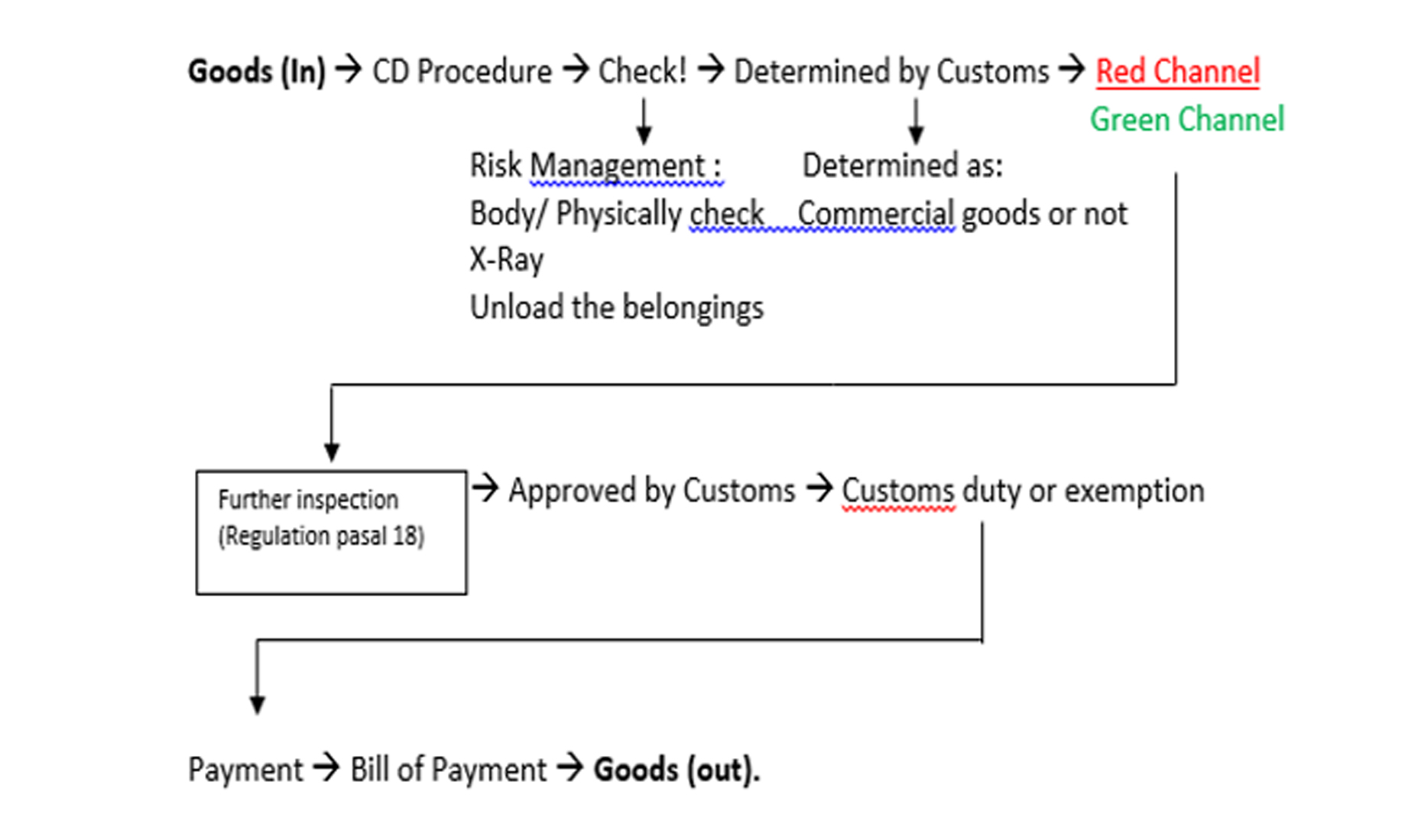

To make it easier about how customs declaration works, here are illustrations to explain the procedure you will pass:

- Getting customs declaration form;

- Arriving at the arrival gate;

- Passing immigration gate;

- Claiming your baggage;

- Submitting the customs declaration;

- Checking your belonging through examination or inspection (if required).

Customs declaration is useful for tracking the goods you bring while visiting Indonesia. It also helps to prevent any illegal conduct, such as smuggling, for protecting the Indonesia citizen from unwanted affair.

PLEASE NOTE THAT THE CURRENT CUSTOMS DECLARATION FILLING CAN BE DONE ONLINE AT THE ECD.BEACUKAI.GO.ID LINK WHICH CAN BE DONE 2 DAYS BEFORE YOUR SCHEDULED ARRIVAL IN INDONESIA.

KNOWING IF YOUR BELONGINGS IS A COMMERCIAL/ NON-PERSONAL GOODS

What is a commercial or non-personal goods? It is a goods that is not intended for personal usage. The goods are brought to be sold, gifted as souvenir, and as sample, raw and auxiliary materials for industry.

If you are travelling with commercial/ non-personal goods, please be noted that commercial/ non-personal goods brought by a passenger or airlines crew is not exempted from customs duty, excise and other taxes. Since commercial/ non-personal good is subject to customs duty, excise and taxes.

Keep it in mind that every item of your belonging is considered as import goods.

FACILITY FOR COMMERCIAL GOODS

If your goods are categorized as commercial goods, you are suggested to choose facility for temporary import. Indonesia’s regulation has two facilities you can choose to import commercial goods for your convenience.

- Temporary Imported Goods

You are highly suggested to use this facility to import your commercial goods since it is more suitable for importing a good amount of goods. Temporary import is divided into two kinds of facility as follow:

Temporary Imported Goods (PMK 142/ 2011)

Temporary import according to PMK 142/ 2011 is determined as an act of importing goods in which will be re-export in 3 years of period. The terms and conditions are applied as follow:

- The goods will not exhausted;

- The goods are easy to identify;

- The goods will not change in shape or formation for 3 years, except they worn out due to utilization;

- The goods are supported by the documents to inform that they will be re-exported.

The period of temporary import permit is granted upon application in accordance with its intended use for a maximum period of 3 (three) years from the date of registration of temporary import customs notification. In the case of temporary import period with less than 3 (three) years, the period of the temporary import permit may be extended more than 1 (one) time based on the application, during the period of temporary import permit in which no more than three years from temporary import customs notification registration.

Can your imported goods get customs exemption? Absolutely yes! However, you need to know the terms and conditions too. For further information and details of the goods in which can be imported with custom exemption, please click here.

How to apply temporary imported goods facility?

You can get this facility by filing an application letter addressed to General Director through the Head of Custom Local Service and Supervisory Offices. However, if you are a passenger of an airlines, this condition can be avoided.

Application Letter must contain at least:

- Details of type, quantity, specification, identity and estimated temporary import customs value;

- Temporary import port of imported goods;

- The purpose of the use of temporary imported goods;

- Temporary use location of imported goods; and

- Temporary import period.

The application must at least be accompanied by these supporting documents as follow:

- Documents stating that the goods will be re-exported; and

- Documents of applicant identity such as NPWP, SIUP and API/APIT.

Keep it in mind that the application you apply could be rejected or accepted. If it is accepted, the Head of Office on behalf of the Minister shall issue temporary import permit. If it is rejected, the Head of Office shall make a notice of rejection of the application by stating the reason for the denial.

Due to temporary imported goods subject to import duty exemption, the importer shall submit a guarantee to the Head of Office at the amount of the import duty and payable imports tax or in which shall be paid on the imported goods concerned. For imported goods temporarily exempted of import duty, an importer shall pay an import duty of 2% (two percent) per month or portion of the month, multiplied by the amount of temporary import period, multiplied by the amount of payable import duty for the imported goods and Value Added Tax or VAT and Sales Tax on Luxury Goods (PPnBM). In addition, on the behalf of the obligation to pay import duty, VAT or PPnBM, the importer shall submit a guarantee of the difference between the incoming fee which should be paid with the paid and the Income Tax according to article 22. Importer shall make import customs notification according to customs supplementary and / or temporary import permit documents that submitted to head of customs office no later than 3 (three) months since date of temporary import permit, accompanied by receipt of payment and / or guarantee. If the delivery of import customs notification exceeds the 3 month time limit, the temporary import permit granted shall be declared no longer valid.

Toward temporary imported goods in a non-new condition and / or subject to the import trade system shall be subject to import approval from the competent authority before the goods discharge from the customs area.

A person who is late in re-exporting imported goods is temporarily liable to administrative sanctions in the form of a fine of 100% (one hundred percent) of the import duty payable. Meanwhile, the person who does not re-export the imported goods is obliged to pay import duty and subject to administrative sanction in the form of a fine of 100% (one hundred percent) of the import duty that should be paid. The importer may be exempt from the obligation to re-export the imported temporary goods and the obligation to settle the shortage of import duty and administrative sanction based on the approval of the Head of Office or Director General due to force majeure condition. The force majeure shall be supported by a statement from the competent authority, and an event report and an official report shall be made by the relevant official.

ATA (Temporary Admission)/ CPD Carnet System

ATA/ CPD Carnet System is the facility to import your goods temporary with customs exemption using a single entry document as the replacement of national customs document. The Carnet permits the equipment or merchandise to pass customs without the payment of import duties and import taxes, such as VAT or GST.

The types of goods that can be imported using ATA/ CPD Carnet System must have these criteria:

- The goods are used for performance or exhibition and other similar events;

- The goods are used as a professional equipment;

- The goods are used for education, science, or culture importance;

- The goods are the tourist or visitor’s needs for exercise (sport equipment);

- The goods are used for humanitarian interest;

- The goods are used as transportation.

Choose ATA Carnet if you intend to bring goods for exhibition/fairs, professional equipment, commercial samples, manufacturing operation, educational-scientific-cultural, traveller’s personal effect-sports purposes, tourist publicity, frontier traffic, humanitarian purposes, and animals.

Choose CDP if you intend to bring any mean of transport.

WHAT IS CUSTOMS CLEARANCE?

What is Customs Clearance? Customs clearance is an activity of passing goods through customs for entering or leaving Indonesia. The goods you bring, either companied or not, will be checked. It is an act of synchronizing your customs declaration with your actual goods you bring. If something unusual is found inside your belongings, further inspection is unavoidable. For example, conducting body or physically inspection, re-checking your goods in X-ray, or even unloading all the goods.

HOW CAN YOU PASS CUSTOMS CLEARANCE?

After declaring the belonging on the customs declaration form and submitting it, you are suggested to determine either your goods will pass the red or green channel. If you bring some or one of items in the red channel, you are obligated to pay tax as a customs duty based on the regulation PMK/ 203/ 2017. Meanwhile, you will be served customs exemption if your items are not categorized in red channel in which it means that your goods passing the green channel. Customs will conduct analysis upon the goods declared and the passenger or crew should proceed the clearance through one of these following channels:

Red Channel, if the passenger or crew brings any of these following items:

- Animals, fish and plants, including their products (vegetables, food, etc);

- Narcotics, psychotropic substances, precursor, drugs and medicines, fire arms, air gun, sharp objects (i.e. sword, knife, etc), ammunitions, explosives and pornographic materials;

- Currency and/or bearer negotiable instrument in Rupiah or other currencies which equal to the amount of 100 million Rupiah or more;

- Tobacco and tobacco products:

- More than 200 cigarettes or 25 cigars or 100 grams of sliced tobacco, and 1 litre beverages containing ethyl alcohol (for passenger); or

- More than 40 cigarettes or 10 cigars or 40 grams of sliced tobacco, and 350 millilitre of beverages containing ethyl alcohol (for crew);

- Commercial merchandise (article for sale, sample used for soliciting order, materials or components used for industrial purposes, and/or goods which are not considered as personal belongings); and/or

- Goods purchased or obtained overseas which will be remain in Indonesian territory and total value exceed USD 500.00 per person and exceeds USD 50.00 per person (for crew).

Green Channel, if your items are not any goods aforementioned above in Red Channel. However, Customs has the authority to conduct physical inspections if there is any suspicious upon goods processed by Green Channel.

- The goods are used for exhibition outside customs dumps;

- The goods are used for seminar;

- The goods are used as illustration or demonstration;

- The goods are needed by expert or scientist;

- The goods are needed for experiment, research, science, and culture

- The goods are used for general performance, sport, or competition;

- Packaging that will be used for the goods to be imported or exported repeatedly or not;

- The goods are used as sample or model;

- The goods could be a yacht that is used by tourist;

Setiap penumpang dan awak sarana pengangkut yang datang dari luar negeri wajib mengisi pemberitahuan pabean menggunakan Customs Declaration (CD) yang saat ini sudah dapat dilakukan pengisiannya secara paperless, yaitu Electronic Customs Declaration (ECD) yang dapat diakses melalui tautan ecd.beacukai.go.id

Electronic Customs Declaration (ECD) dapat diisi 2 hari sebelum tanggal kedatangan Anda di Indonesia, dan untuk diketahui kini ECD sudah terhubung dengan layanan Registrasi IMEI.

Lakukan pengisian dengan benar dan sesuai tahapan-tahapan yang sudah disediakan sampai mendapatkan QR Code. QR code dari hasil pengisian tersebut akan muncul pada email Anda ataupun dapat langsung diunduh untuk ditunjukkan kepada petugas Bea dan Cukai di Customs Area.

Persiapkan dokumen-dokumen pendukung untuk melakukan pengisian Electronic Customs Declaration (ECD) seperti :

- Paspor

- Alamat email.

- Tiket atau boarding pass.

- Dokumen-dokumen penting yang mendukung barang bawaan Anda sesuai ketentuan yang berlaku saat kedatangan di Indonesia.

- Untuk melakukan registrasi IMEI klik “yes” dan silahkan diisi kolom-kolom yang sudah tersedia.

Untuk diketahui bahwa dasar hukum kegiatan ini adalah Peraturan Menteri Keuangan Republik Indonesia Nomor 203/PMK.04/2017 tentang Ketentuan Ekspor Dan Impor Barang yang Dibawa oleh Penumpang dan Awak Sarana Pengangkut.

Apa itu kategori barang personal use dan non-personal use?

Barang pribadi penumpang atau barang pribadi awak sarana pengangkut yang dipergunakan/dipakai untuk keperluan pribadi termasuk sisa perbekalan (personal use); dan/atau

barang impor yang dibawa oleh penumpang atau barang impor yang dibawa oleh awak sarana pengangkut selain barang pribadi (non-personal use).

Berapa nilai pembebasan Bea Masuk dan Pajak Dalam Rangka Impor (PDRI) yang diberikan?

Untuk kategori barang personal use yang dibawa oleh penumpang diberikan Pembebasan Bea Masuk dan Pajak Dalam Rangka Impor (PDRI) dengan nilai pabean paling banyak FOB USD 500 (lima ratus Dolar Amerika Serikat) per orang untuk setiap kedatangan, sedangkan untuk awak sarana pengangkut adalah sebesar FOB USD 50 (lima puluh Dolar Amerika Serikat) per orang untuk setiap kedatangan. Dalam hal nilai pabean melebihi batasan nilai pembebasan yang sudah ditentukan, maka atas kelebihannya dipungut Bea Masuk dan Pajak Dalam Rangka Impor (PDRI) sesuai ketentuan yang berlaku.

Sedangkan untuk kategori barang non-personal use akan dipungut Bea Masuk dan Pajak Dalam Rangka Impor sesuai ketentuan yang berlaku.

Bagaimana dengan pembebasan Barang Kena Cukai (BKC)?

Terhadap kategori barang personal use yang dibawa oleh penumpang yang merupakan Barang Kena Cukai (BKC), diberikan pembebasan cukai untuk setiap orang dewasa dengan jumlah paling banyak:

- 200 batang sigaret,

- 25 batang cerutu,

- atau 100 gram tembakau iris/produk hasil tembakau lainnya; dan/atau

- 1 (satu) liter minuman mengandung etil alcohol (dewasa 21 tahun keatas).

Sedangkan terhadap kategori barang personal use yang dibawa oleh awak sarana pengangkut yang merupakan Barang Kena Cukai (BKC), diberikan pembebasan cukai untuk setiap orang dewasa dengan jumlah paling banyak:

- 40 batang sigaret,

- 10 batang cerutu,

- atau 40 gram tembakau iris/produk hasil tembakau lainnya; dan/atau

- 350 mililiter minuman mengandung etil alcohol.

Dalam hal jumlah Barang Kena Cukai (BKC) tersebut melebihi batasan yang sudah ditentukan, maka atas kelebihannya dimusnahkan oleh Pejabat Bea dan Cukai dengan atau tanpa disaksikan oleh Penumpang atau Awak Sarana Pengangkut yang bersangkutan.

Daftar barang bawaan penumpang dan awak sarana pengangkut

Pada saat Anda melakukan pengisian informasi atas barang bawaan pada Electronic Customs Declaration (ECD), maka akan terdapat halaman “Barang Bawaan” dan Anda akan ditampilkan barang-barang yang mungkin ingin diberitahukan jika Anda membawanya (silahkan klik”yes” jika Anda ingin memberitahukan).

Dan untuk diperhatikan, dalam hal tata cara pembawaan barang tersebut agar dipahami terlebih dahulu peraturan-peraturan yang menyertainya, agar pada saat dilakukan pemeriksaan oleh Petugas Bea Cukai dapat terhindar dari permasalahan yang mungkin timbul dari barang-barang yang Anda bawa, karena beberapa barang memerlukan perijinan dari Instansi terkait. Berikut daftar barang-barang pada halaman “Barang Bawaan” :

- Hewan, ikan, dan tumbuhan termasuk produk yang berasal dari hewan, ikan dan tumbuhan.

- Narkotika, psikotropika, prekursor, obat-obatan, senjata api, senjata angin, senjata tajam (pedang, pisau), amunisi, bahan peledak, benda/publikasi pornografi.

- Uang dan/atau instrumen pembayaran lainnya dalam rupiah atau dalam mata uang asing senilai Rp 100.000.000 (seratus juta rupiah) atau lebih.

- Uang kertas asing paling sedikit setara dengan Rp. 1.000.000.000,00 (Satu Milyar Rupiah).

- Lebih dari 200 batang sigaret atau 25 batang cerutu atau 100 gram tembakau iris/hasil tembakau lainnya dan 1 liter minuman mengandung etil alkohol atau lebih dari 40 batang sigaret atau 10 batang cerutu atau 50 gram tembakau iris/hasil tembakau lainnya dan 350 mililiter minuman mengandung etil alcohol.

- Barang untuk keperluan pribadi yang dibeli/diperoleh dari luar negeri dan tidak akan dibawa kembali ke luar negeri dengan nilai melebihi USD 500 ; atau USD 50.

- Barang impor yang akan digunakan untuk tujuan selain pemakaian pribadi (jumlah tidak wajar untuk dipakai/dikonsumsi sendiri atau untuk keperluan perusahaan/toko/industri).

- Membawa barang yang berasal dari Indonesia yang pada pengeluaran barang dari Indonesia menggunakan BC 3.4.

Untuk barang-barang yang menggunakan fasilitas Impor Sementara, ATA Carnet ataupun fasilitas lainnya silahkan melapor kepada Petugas Bea dan Cukai untuk dilakukan proses lebih lanjut.